Scotland's Kinkiest Families

November 14, 2021

I’ve finally put some of this model out into the world - to almost zero response so far, but that’s OK.

This was originally just a testing exercise. The Budget Constraint generator has always been a great way of ferreting out all the weirdness in a model: it finds all the discontinuities, marginal effective tax rates (METRs) that go the ‘wrong’ way.

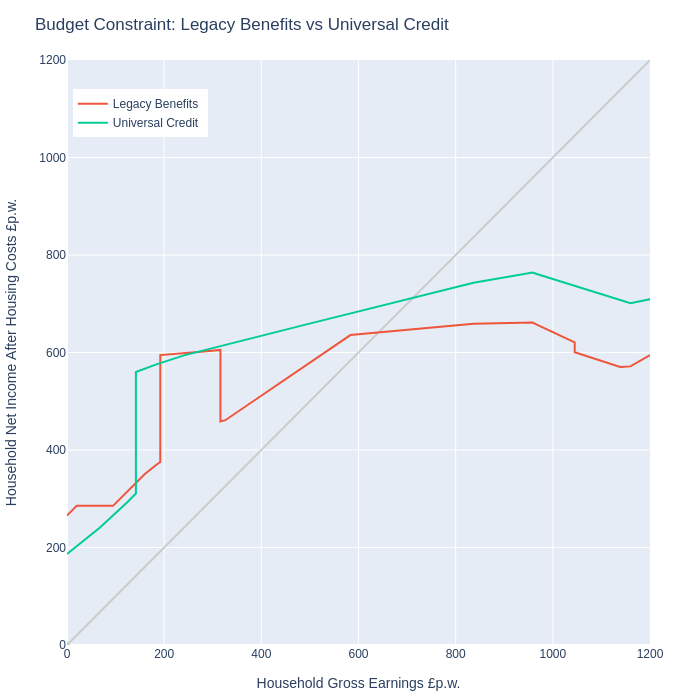

Like this one:

This shows the gross/net income relationship for a family with 7 children and £270pw in housing costs, living in a council house. So a pretty unusual family, but still.. Both the legacy system (red) and UC (greeen) are shown.

There’s a lot going on here. Key things are:

- Benefit Cap. This limits the amount of benefits received, but not for Working Tax Credit recipients (Legacy) and only for those earning below £617pm (UC). Hence the big jumps upward at the points where the family qualifies for WTC or earns £617, and back down in the Legacy case when WTC entitlement is exausted.

- The downward sections on the right are a combination of child benefit withdrawal over £50,000 per year (50%), higher rate income tax, and UC/WTC withdrawal (these can go surprisingly high up for large families).

- There are other weird ones, too, like the interaction between the Discresionary Housing Payments the Scottish government use to ameliorate the Bedroom Tax and the benefit cap - these combined can produce negative marginal tax rates.

Category: Blog

Tags:

Incentives